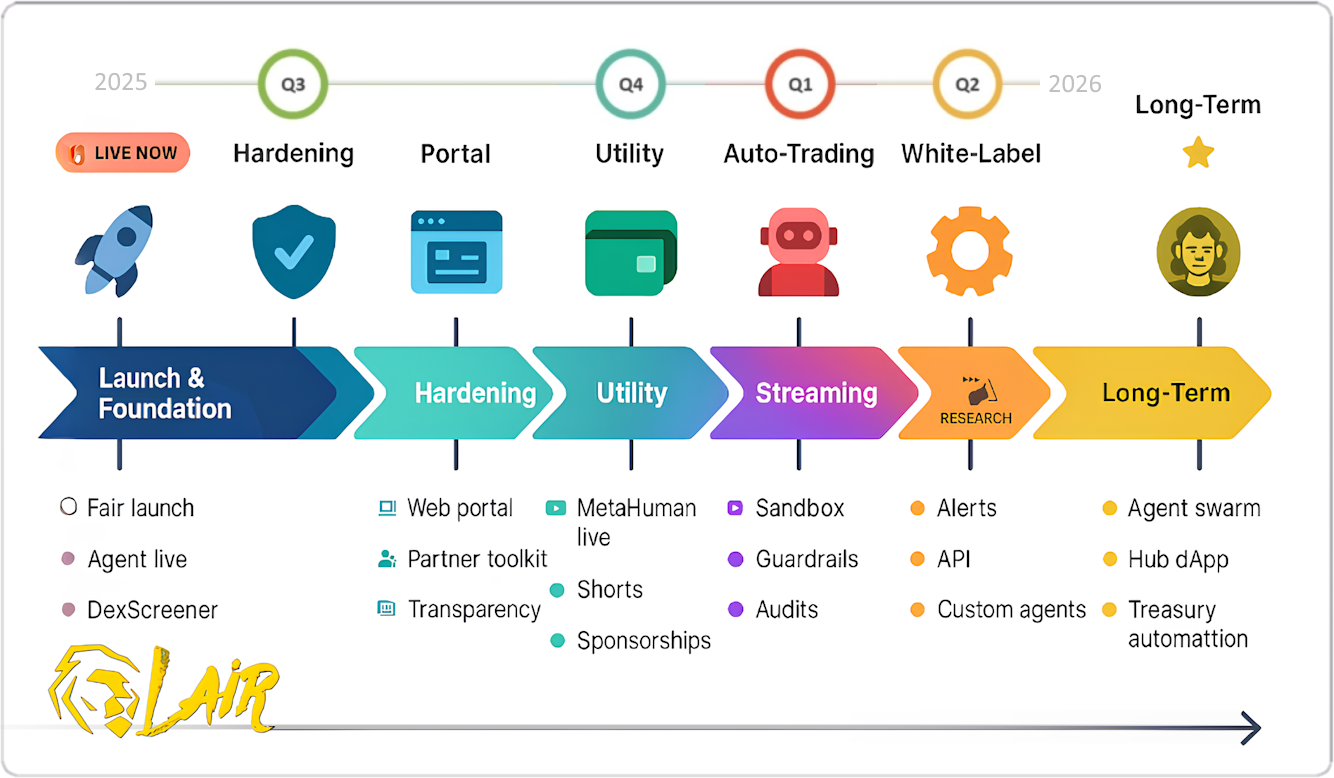

Phase 0 — Foundation (DONE / LIVE)

- Launch & graduation: fair launch via WolfStreet; graduated with program benefits.

- Liquidity & locks: dev wallet locked (~4% for 6 months).

- Agent live on socials: commands for

CHART,ANALYSIS,FUNDAMENTAL,PRICE,NEWS,SENTIMENTwith$TICKERorCA. - Market presence: profile and live data on Dexscreener; ongoing comms on X & Telegram.

Ongoing: stability fixes, latency improvements, moderation, uptime SLOs.

Phase 1 — Post-Launch Hardening (Week 1–4)

- Data & signal upgrades

- Faster token scanners (volume/hype/momentum).

- Deeper fundamentals (LP health, holder dispersion, contract flags).

- Chart presets with EMA/VWAP/RSI.

- UX & reach

- Reply quality tuning, clearer error handling, command hints.

- Telegram mirror bot for community use.

- Liquidity program

- VVS Pool after migration.

- Incentivized pool with KPI-based rewards.

- Security & reliability

- Rate-limit & anti-spam on endpoints.

- Monitoring dashboards and incident runbooks.

Deliverables: changelog v1, vault announcement, LP plan, status page.

Phase 2 — Productization (Month 1–2)

- LAIR Portal (web)

- Command explorer & live feed.

- “Try it” widgets with pre-filled prompts.

- Accountless credits + pay-per-feature for power users.

- Partner toolkit (B2B)

- White-label/custom agents for projects & KOLs.

- Team dashboards (usage analytics, heatmaps).

- Listings & integrations

- Additional DEX integrations on Cronos.

- CEX listing framework (OTC, MM wallets, unlock policies).

- Transparency

- Dev-wallet & LP dashboards.

- Quarterly transparency report.

Deliverables: LAIR Portal v1, partner pilots, listing playbook, dashboards.

Phase 3 — dApp & Token Utility Expansion (Month 2–4)

- dApp rollout (beta → public)

- Wallet connect, profile, service menu.

- Token-gated usage:

- Lock $LAIR → enable bot in private TG/Discord.

- Stake tiers → unlock alerts, reports, voice spots.

- Premium payments → deep analysis packs.

- Airdrops & rewards

- Periodic airdrops for active users & LP stakers.

- Reward vaults tied to engagement.

- Marketplace

- Menu of services: custom alerts, post scheduling, audits.

- Future: template & plugin marketplace (rev share in $LAIR).

- Economic flywheel

- Revenue → treasury → buyback & burn.

- Early unlocks → burn % of locked tokens.

Phase 4 — Streaming & Content Engine (Month 3–5)

- Live presence

- MetaHuman streaming on Twitch, YouTube, X.

- Real-time chart overlays, news reads, sentiment updates.

- Auto-clipped shorts distributed on TikTok, Reels, Shorts.

- Community growth

- Sponsored reads, KOL integrations.

- Weekly “State of Cronos” reports streamed and posted.

- Monetization

- Voice spot auctions (paid in $LAIR).

- Premium placements & sponsor mentions.

Deliverables: live channels, content engine, monetization pilots.

Phase 5 — Research & Guardrails for Auto-Trading (Month 4–6)

Auto-trading will not go public until safety, audits, and risk checks pass.

- Risk & compliance layer

- Sandbox with slippage/latency simulation.

- Risk rails: stop limits, cooldowns, news-halt triggers.

- Multi-sig governance for strategy changes.

- Execution adapters (Cronos DEXs)

- Market & limit orders.

- Backtesting with telemetry.

- Audit & review

- Third-party review of guardrails.

- Bug bounty program.

Deliverables: “Auto-Trading Readiness” report, sandbox metrics, audits.

Phase 6 — Ecosystem Growth & White-Label (Month 6–8)

- Signal distribution

- Alerts: trending tokens, listings, capital flows.

- Weekly Cronos briefs by LAIR.

- Economics & burns

- Feature credits and partner tiers.

- Revenue sinks → periodic burns.

- White-label agents

- Custom branded agents for projects/communities.

- Pricing in $LAIR or revenue share.

- Analytics API

- Read-only endpoints for charts, fundamentals, sentiment.

Deliverables: API beta, white-label rollout, burn reports.

Phase 7 — MetaHuman Expansion & Advanced Avatars (Month 9–12)

- Instanced avatars

- One-to-one agents: personalized companion with memory & filters.

- One-to-many agents: scalable MetaHuman hosts for AMAs, streams, events.

- Streaming upgrades

- Multi-language support, scene automation, branded overlays.

- API hooks for sponsors & community voting.

- Monetization layer

- Paid avatar sessions.

- Premium group access (voice/video, one-to-one calls).

Deliverables: avatar instancing beta, one-to-one private demo, community AMA pilots.

Long-Term Vision (Month 12+)

- Agent swarm model: specialized LAIR agents (narrative scanner, sentiment-only, compliance auditor).

- Community hub dApp: unified portal for staking, rewards, plugins, marketplace.

- Enterprise deals: full-service white-label MetaHuman agents for exchanges, projects, and DAOs.

- Treasury automation: fully autonomous cycle → revenue → treasury → buyback → burn → reward.

- Institutional toolkit: risk dashboards, strategy audits, reporting modules.

Always-On Tracks

- Security: key rotations, least-privilege, logs.

- Performance: latency budgets, caching, fallback.

- Compliance: NFA/DYOR labels, disclosures, audits.